Performance | Management

The Strategy our Experienced Discretionary Trader concentrates on uses few Major currency pairs and mostly Minor Pairs.

Adopting a purely technical approach using price, technical patterns and trend formations to map market entry and exit using a precision ‘low risk’ order approach with a high value volume to compensate for both economic and political ‘breakout’ market scenarios.

The Strategy can be tailored to each clients risk appetite to achieve higher or lower potential results. Most sophisticated and institutional investors favour such an approach to market trading.

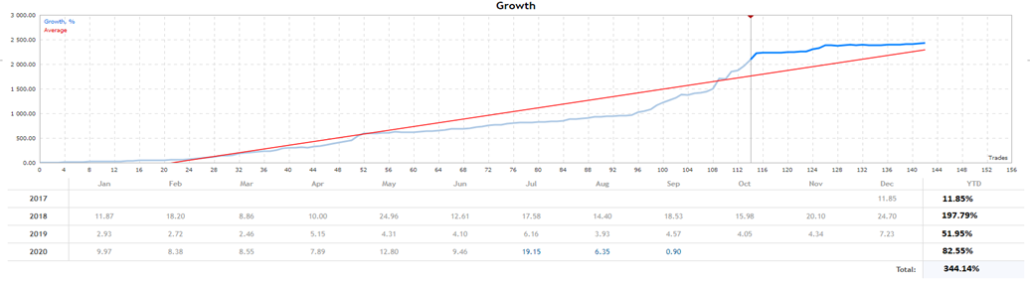

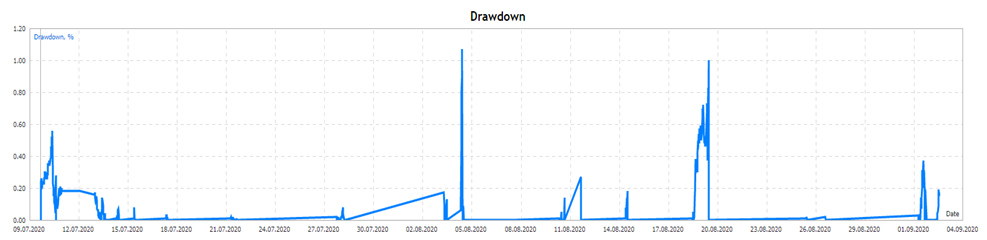

Trade began: Dec 2017 | Trades: 166 | Profit Trades: 147 (88.55%) | Loss Trades: 19 (11.45%) | Recovery Factor: 38.56 | Long Trades: 68 (40.96%) | Short Trades: 98 (59.04%) | Trades per week: 9 | Avg holding time: 21 hours | Leverage: 100:1| Profit Factor: 20.53

We partner with an Asset Management Company that Offers a complete ‘Managed Service Solution’ whereas Forex Trading; including Account configuration/Risk profile can be Discussed and implemented upon the Client’s request and parameters.

The Client is and shall always remain in 100% control of their own funds.

To begin opening an account with our partner broker platform Scandinavian Capital Markets is simple and fast – you should request a leverage of 100:1 with a RAW-type spread account using MetaTrader 4.

you can request a Forex Trading Brochure my emailing support@forshawcapitalgroup.com