Oil Market to re-balance by mid-year

Supply side issues continue to drive sentiment in the crude oil market, strategists at ANZ Bank apprise.

“Saudi Arabia aims to pump just under 7.5mb/d in June, compared with its official target of 8.5mb/d. This would take its output to the lowest level since mid-2002. The United Arab Emirates also announced it would cut by an additional 100kb/d in June.”

“Continental Resources expects the market to re-balance by mid-year, and will reopen oil wells quickly once prices recover.”

“And while demand appears to be recovering, there are also doubts as to its timing. In the US, the volume of fuel sold by retailers rose by only 7% in the week ending 2 May. In Europe, the varying degrees of lock-downs continue to hobble demand.”

Further downside still on the cards

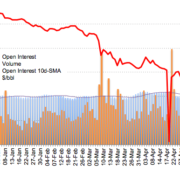

Traders increased their open interest positions for the second day in a row on Monday, now by nearly 5.2K contracts in light of advanced figures from CME Group. In the same direction, volume extended the erratic performance and went up by almost 94K contracts, partially reversing the previous large drop.

WTI could re-visit the $20.00/bbl mark

Prices of the WTI appear to have met important resistance around the $28.00 mark per barrel. Monday’s correction lower was amidst rising open interest, which is indicative that a deeper pullback could be in the offing in the short-term horizon.